In today’s world, where healthcare costs are soaring, it is crucial to prioritize health insurance, especially for senior citizens. This article aims to shed light on the significance of senior citizen health insurance and the various factors that make it essential.

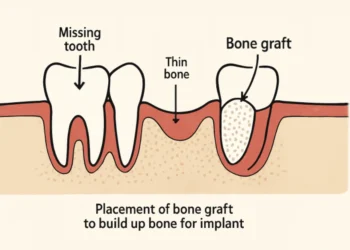

In addition to safeguarding against rising healthcare costs, prioritizing health insurance becomes even more crucial for senior citizens who may require extensive dental care, including the possibility of availing of the finest dental crowns. Proper coverage ensures access to advanced dental treatments, contributing to overall well-being in their golden years.

Individuals can make informed decisions that protect their well-being and financial stability by understanding the importance of securing adequate coverage.

Definition of Senior Citizen Health Insurance

Senior citizen health insurance refers to specialized insurance policies designed to cater to the unique healthcare needs of older individuals. These policies cover medical expenses, hospitalization costs, and other related services. By providing financial protection, senior citizen health insurance ensures seniors can access the required healthcare services without shouldering exorbitant expenses.

Cost of Health Insurance for Seniors

Medicare as a Cost-Effective Option

One cost-effective option available to seniors is Medicare. Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older and certain younger individuals with disabilities. It offers various plans, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). Medicare provides a safety net that helps alleviate the burden of healthcare costs for seniors.

Average Monthly Cost for Seniors

The average monthly cost of health insurance for seniors can vary depending on several factors, including the type of coverage, the individual’s age, and their location. However, it is important to note that the cost of not having insurance can far outweigh the premiums paid. Investing in health insurance ensures that seniors can access timely medical care without worrying about the financial implications.

Tax-Deductibility of Health Insurance Premiums

In certain cases, health insurance premiums for seniors may be tax-deductible. This can provide additional financial relief by reducing the overall tax liability. Seniors should consult a tax professional to understand their jurisdiction’s tax benefits and deductions.

Rising Medical Expenses

Medical Inflation and Its Impact on Seniors

One of the significant challenges seniors face is the impact of medical inflation. As healthcare costs continue to rise, it becomes increasingly important to have adequate health insurance coverage. With insurance, seniors may find it easier to afford necessary medical treatments, medications, and healthcare services. Senior citizen health insurance protects against rising expenses, ensuring seniors receive the care they need without compromising their financial security.

Importance of Securing Family Finances through Insurance

Securing family finances through health insurance is crucial, especially for seniors. Unforeseen medical emergencies can deplete savings and put a strain on the financial well-being of the entire family. Seniors can protect their loved ones from high medical expenses through comprehensive health insurance coverage. It provides peace of mind and ensures that the family’s financial future remains stable.

Health Insurance Coverage for Seniors

Medicare Coverage for Seniors

Medicare offers comprehensive coverage for seniors, including hospital stays, doctor visits, preventive care, and prescription drugs. It is a government-funded program that provides a safety net for individuals aged 65 and older. Medicare coverage is divided into various parts, each addressing specific healthcare needs. Understanding the different parts of Medicare helps seniors choose the most suitable coverage options for their requirements.

Private Insurance Options for Seniors

In addition to Medicare, there are private insurance options available for seniors. These insurance plans may offer additional benefits and more personalized coverage options. Seniors must explore and compare different private insurance plans to find the one that best suits their healthcare needs and budget.

- Medicare Advantage Plans: Also known as Medicare Part C, these plans are offered by private insurance companies approved by Medicare. They combine the benefits of Medicare Parts A and B, often including additional coverage such as prescription drugs and dental, vision, and hearing services.

- Medigap (Medicare Supplement) Plans: Medigap plans are offered by private insurers and are designed to fill the gaps in Medicare coverage, such as deductibles, coinsurance, and copayments. These plans work alongside Original Medicare (Parts A and B) and help cover out-of-pocket expenses.

- Prescription Drug Plans (Part D): Part D plans are standalone prescription drug plans offered by private insurers. They provide coverage for prescription medications and can be added to Original Medicare or certain Medicare Advantage Plans.

- Long-Term Care Insurance: Long-term care insurance covers services not typically covered by health insurance, such as assistance with activities of daily living (e.g., bathing, dressing, eating) in a nursing home, assisted living facility, or at home. These policies can help cover the costs of long-term healthcare services.

- Private Health Insurance Plans: Some private insurers offer health insurance plans tailored to seniors. These plans may cover preventive care, hospitalization, doctor visits, prescription drugs, and other healthcare services.

Reasons Why Health Insurance Is Essential for Seniors

Individuals become more vulnerable to various health conditions and diseases as they age. Senior citizens often require regular medical check-ups, specialized treatments, and medications. Health insurance provides the necessary financial support to access these essential healthcare services, ensuring seniors can maintain their well-being and enjoy a good quality of life.

Being proactive about health insurance is crucial for seniors. It is advisable to secure health insurance coverage before health issues arise. By being proactive, seniors can avoid potential gaps in coverage and ensure they have the necessary protection. Regular check-ups, preventive care, and early intervention can significantly improve health outcomes for seniors.

Importance of Early Enrollment

One important factor to consider when enrolling in health insurance is the impact of age on insurance premiums. As individuals grow older, insurance premiums tend to increase. By enrolling in health insurance early, seniors can lock in lower premiums and secure comprehensive coverage that caters to their evolving healthcare needs.

Early enrollment in senior citizen health insurance allows individuals to use cost-saving measures. Insurance providers often offer discounts and benefits for early enrollment, ensuring that seniors can access affordable coverage without compromising the quality of care. By taking proactive measures and enrolling early, seniors can optimize their insurance coverage while saving on costs.

Group Health Insurance and Family Plans

Some employers offer group health insurance plans that extend coverage to the parents of their employees. This can be advantageous for seniors who may not be eligible for Medicare or are looking for additional coverage beyond what Medicare provides. Group insurance plans often offer competitive premiums and comprehensive coverage, making them a viable choice for seniors.

Family health plans are another option for seniors to consider. These plans provide coverage for the entire family, including senior members. While the coverage may vary depending on the specific plan, family health plans often offer comprehensive benefits catering to seniors’ healthcare needs. It is essential to carefully review the terms and coverage limits of family health plans to ensure that they adequately meet the medical requirements of seniors.

Specific Health Insurance Plans for Seniors

Care Senior Citizen Health Insurance is a specialized plan designed for seniors. It offers a range of features tailored to address the unique healthcare needs of older individuals. These features may include coverage for hospitalization, pre- and post-hospitalization expenses, ambulance services, and critical illness treatments. Care Senior Citizen Health Insurance aims to provide comprehensive coverage that ensures seniors receive medical care without financial strain.

Various insurance providers offer benefits and discounts specifically for seniors. These may include reduced premiums, coverage for pre-existing conditions, wellness programs, and additional services such as telemedicine consultations. Seniors should explore their options and compare different insurance plans to find the most suitable benefits and discounts for their needs.

Benefits of Senior Citizen Health Insurance

Senior citizen health insurance often includes coverage for pre- and post-hospitalization costs. This coverage extends financial support for medical expenses incurred before and after a hospital stay, including diagnostic tests, medications, and follow-up consultations. By covering these expenses, senior citizen health insurance ensures seniors can focus on their recovery without worrying about the associated financial burden.

Insurance providers may offer discounts and benefits that help reduce senior citizen health insurance premiums. These discounts can be based on a healthy lifestyle, regular preventive check-ups, or loyalty to an insurer. By taking advantage of these discounts and benefits, seniors can make their health insurance more affordable while maintaining comprehensive coverage.

Importance of Cashless Hospitalization

Without proper insurance coverage, seniors may face significant financial pressure when dealing with medical emergencies. Hospitalization expenses can quickly deplete retirement savings and risk seniors’ economic security. Cashless hospitalization, a feature many health insurance plans offer, allows seniors to receive medical treatment without upfront payment. This reduces the financial strain and ensures seniors can access quality healthcare when needed.

Suitable health insurance is essential for seniors to maintain financial security. By having comprehensive coverage, seniors can protect their savings and retirement corpus from being exhausted by unexpected medical expenses. Health insurance provides a safety net that ensures financial stability, allowing seniors to enjoy their retirement without worrying about healthcare’s economic implications.

Medicare Coverage Details

Medicare Part A provides hospital coverage for seniors. It includes inpatient hospital stays, skilled nursing care, hospice care, and home health services. Understanding the coverage details under Medicare Part A is crucial for seniors to make informed decisions about their healthcare needs and ensure they have the necessary coverage for hospitalization.

Seniors become eligible for Medicare at the age of 65. However, seniors must be aware of specific eligibility criteria and enrollment periods. Understanding the requirements and timelines is important to ensure timely enrollment and uninterrupted access to Medicare benefits.

Conclusion

Senior citizen health insurance ensures older individuals’ well-being and financial security. With the rising healthcare costs and the increased vulnerability to health conditions with age, comprehensive health insurance coverage is essential. Whether through Medicare or private insurance options, seniors should prioritize enrolling in suitable health insurance plans that address their unique healthcare needs. By doing so, they can protect their health, secure their finances, and enjoy a worry-free retirement.